Family Values

For almost all shareholders of public companies, success is easy to define: maximise shareholder returns. But for small to medium family-owned companies, that’s seldom true.

Most small business owners we know, especially family-owned businesses, are not obsessed with quarterly targets, price-earnings ratios or pandering to stock exchange vicissitudes. Having the freedom to set your own goals for success is one of the greatest advantages of being a small business owner.

Except, it’s also a disadvantage. Too often, we see small business owners accept mediocrity by not setting explicit, well-defined goals. More specifically, they have too many goals and lack of focus.

If you’re a co-owner in a family business, then you’re virtually guaranteed to suffer the too-many-goals challenge. Even if you have a concentrated ownership structure where one person owns the majority of the company.

It’s easy for a family-run business to fall into the trap of trying to satisfy the whole family’s needs. When there’s no impersonal shareholder pushing for financial returns, competing priorities arise, like guaranteed employment for family members, extra fringe benefits, or taking family holidays under the ruse of business travel.

There’s nothing wrong with non-financial goals; the problem is having too many, or at least not ranking them from the highest priority goal that trumps all others down to the most mutable goal. Without clear long-term objectives, the family business can drift from their reason for existing and owners are more easily tempted to cash out when the meaning is lost, especially as each generation passes through the doors.

What’s needed is a way of prioritising your goals and setting just one over-arching strategy to match your family values.

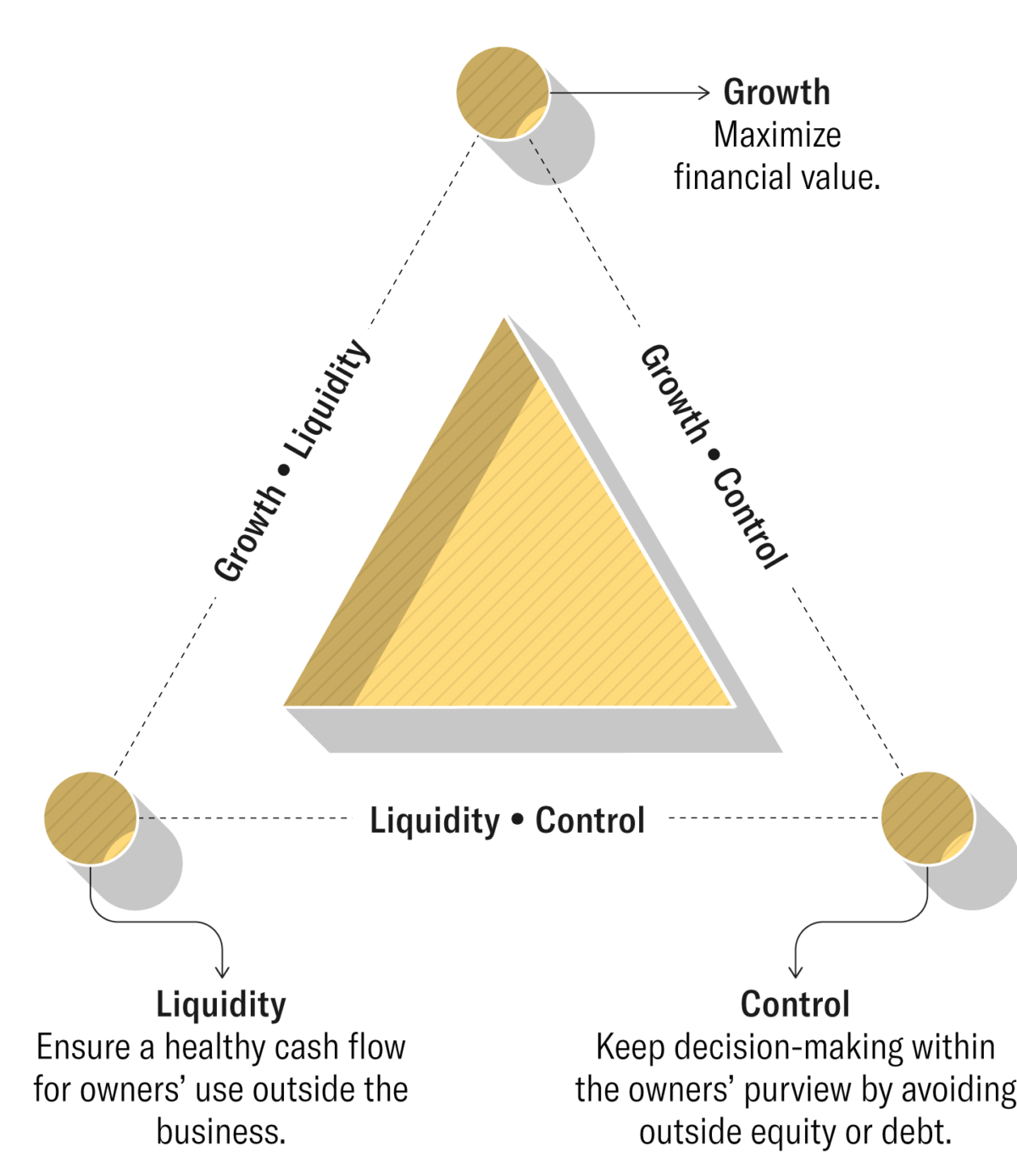

As with any small business, the goal categories are growth, liquidity and control. (Harvard Business Review) The problem is, you can only pick 2 in the short- to medium term. This leaves you with a choice between 3 pairs of goal types:

- Growth-control goals keep the power in the family while growing the business, but they struggle to pay good returns to the owners.

- Growth-liquidity companies aim to grow by using outsider’s money to pay good returns to owners. This usually involves giving up some control to take on equity investors.

- Liquidity-control companies strive to give the owners a healthy cash flow while they retain authority, but this company will struggle to scale.

There’s plenty of wiggle room to set a small selection of long-term objectives unique to just your family and business. It’s important to know how these goals drive business planning, investment decisions and daily operations. What you do and what you avoid should all be aligned with your top priorities. And your top priorities should be aligned with your family values.

When your business goals fit your family, then you’ll have a business that serves your family, whether you define success as growth, free cash flows or a job for life.

(Image credit: Daily Muse Inc.)